Crunching numbers. Please wait...

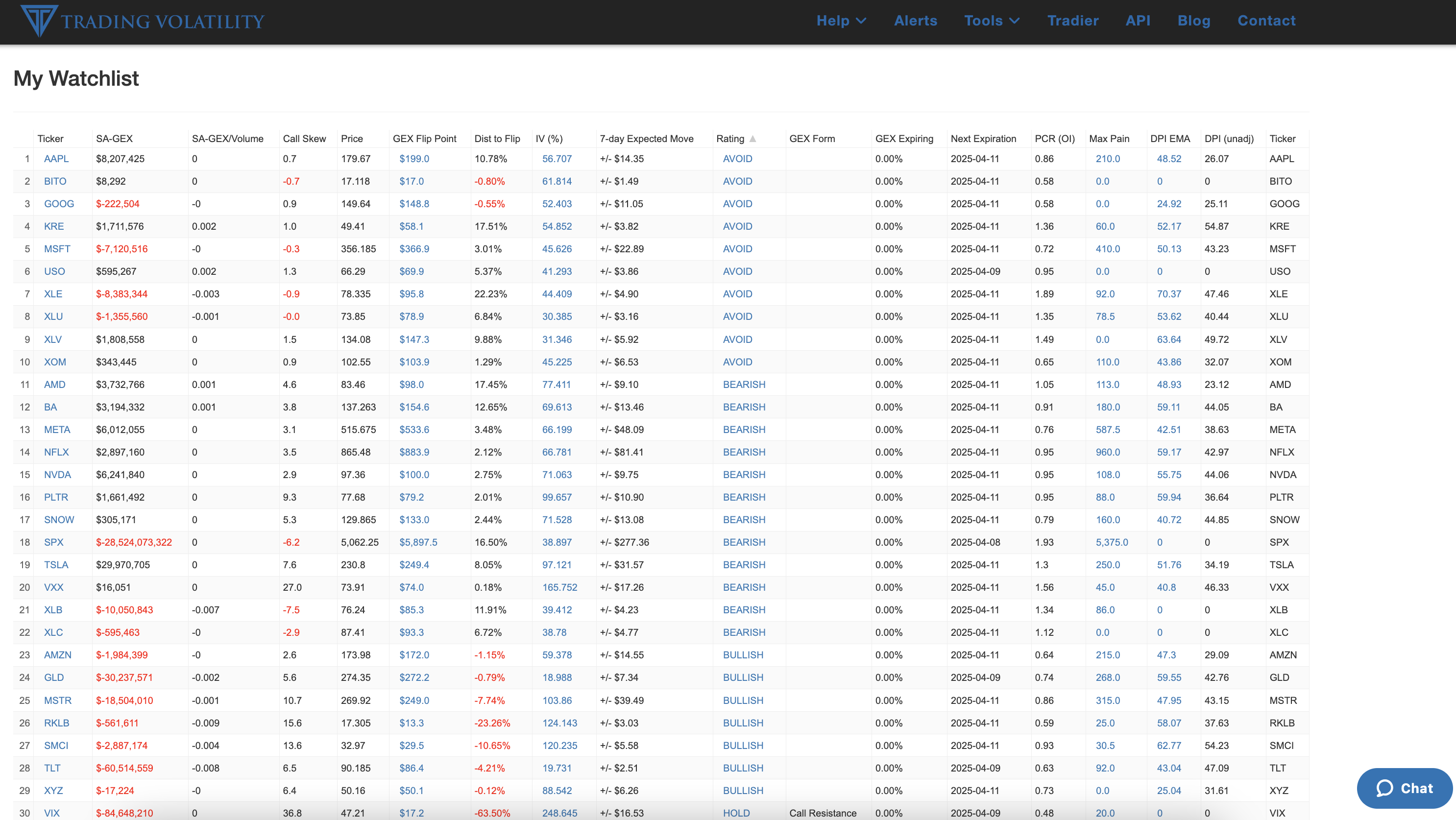

How to Use the "My Watchlist" Dashboard

Your personalized My Watchlist dashboard is a powerful tool to help you track the names you care about and make data-driven decisions. This guide walks you through how to use some key columns.

Getting Started

To start using your personalized dashboard you must first enter as many as 40 tickers that you would like to track. This will provide key statistics on the My Dashboard page and allow for a daily email (activate up on your Alerts page) with GEX data and ratings changes.

1. Use the Rating as a Compass

The “Rating” column provides a simplified summary of the data. Use it to filter your list.

- BULLISH: Typically better setups with supportive structure.

- HOLD: Expect consolidation / pullback while in a bullish trend.

- AVOID: Lacks strong direction.

- WAIT: Transitional setups, usually occurs when a stock is attempting a bottom.

- BEARISH: Downside risk or unfavorable positioning.

Takeaway: Start with the rating, then confirm the signal using GEX and Dist to Flip.

2. Close to GEX Flip = Higher potential for direction change

Example: AMZN → GEX: -$1,984,399, Dist to Flip: -1.15%

- A small or negative “Dist to Flip” means the stock is near a key transition point in positioning.

- The rating will change as price crosses above or below the GEX Flip point.

Takeaway: Crossing a GEX flip point is often a good place to enter or exit a position.

3. High IV + BEARISH Rating = Overpriced Risk

Example: AMD → IV: 77, Rating: BEARISH, GEX: $3.7M

- High implied volatility means option prices are inflated—you're paying top dollar for puts. To determine if IV is "high" for a stock you can check that stocks Skew Charts page for a historical context of IV.

- A bearish rating indicates downside pressure, with limited edge for new entries.

Takeaway: When IV is high and the rating is BEARISH, the setup is skewed against you. Sit this one out.

Real Use Case 1: Should I Buy ADBE?

Dashboard Data:

- GEX:

$1.9M - Dist to Flip:

17.95% - IV:

45.27% - Rating:

WAIT

Interpretation: ADBE has undergone a downtrend and is attempting to find support at an oversold level, coinciding with "PUT SUPPORT" where there is a large concentration of put gamma.

Action: Wait for GEX to shift better structure, ideally crossing above the GEX Flip point.

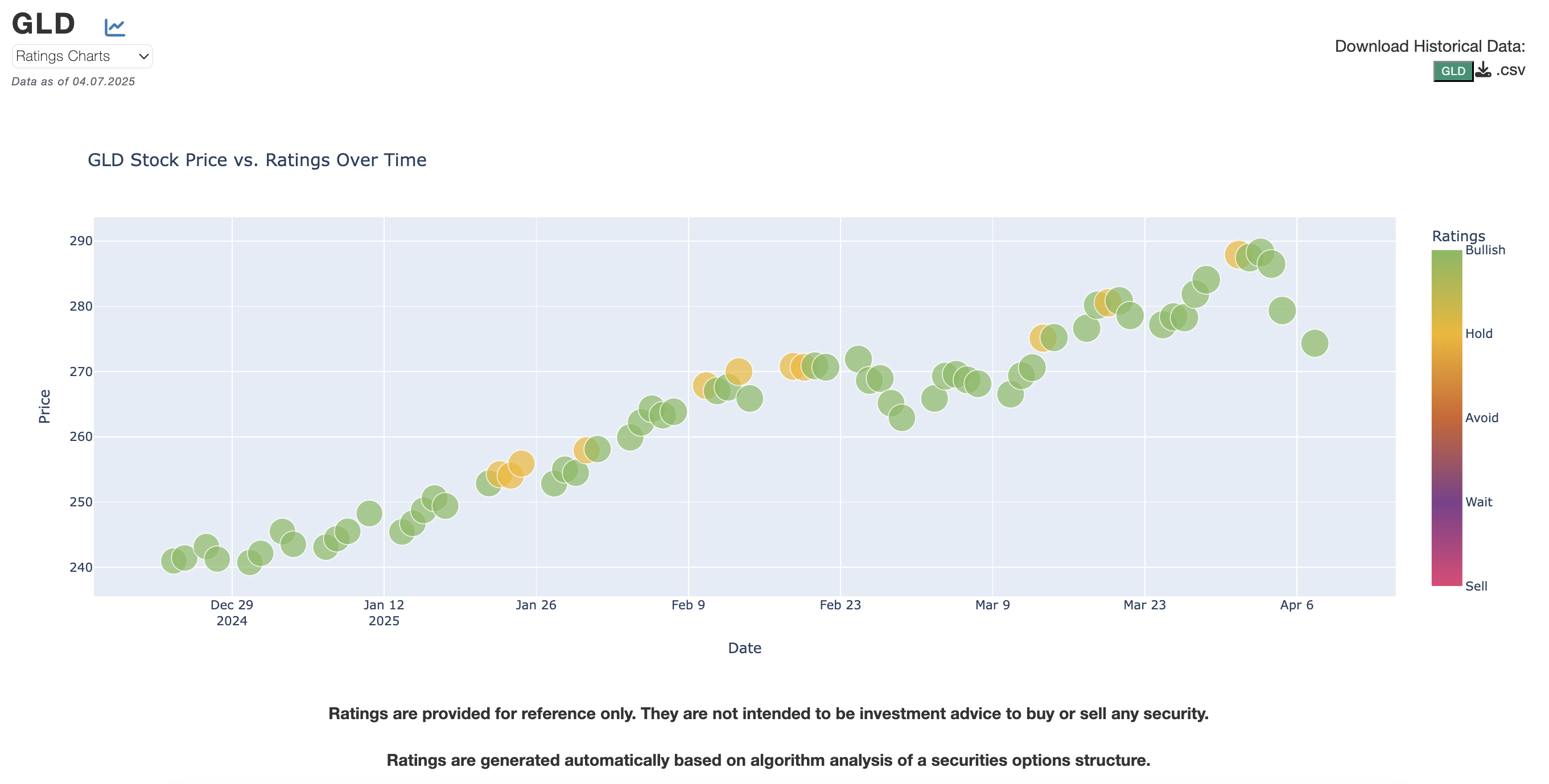

Real Use Case 2: Should I Buy GLD?

Dashboard Data:

- GEX:

-$30M - Dist to Flip:

-0.79% - IV:

18.9% - Rating:

BULLISH

Interpretation: GLD is in a bullish trend. However, it should be monitored as it is close to the GEX Flip level where the rating would likely change.

Action: Continue to hold if you own it. However, it is not an ideal time to establish a new position since the trend has been in place for quite a while.

Final Tips

- Start with just 3 columns: GEX, Dist to Flip, and Rating.

- Good long entries typically include:

- Negative GEX with positive call skew.

- Positive GEX with negative call skew.

- A BULLISH rating.

Need more help? Check out more guides in our Education Center.

We’re building additional walkthroughs to help you get the most out of Trading Volatility. Let us know what you’d like to see next!

Not a subscriber yet? Create your account to access the full dashboard and daily alerts.