Crunching numbers. Please wait...

You must Sign In with a valid subscription or day pass for access to this page.

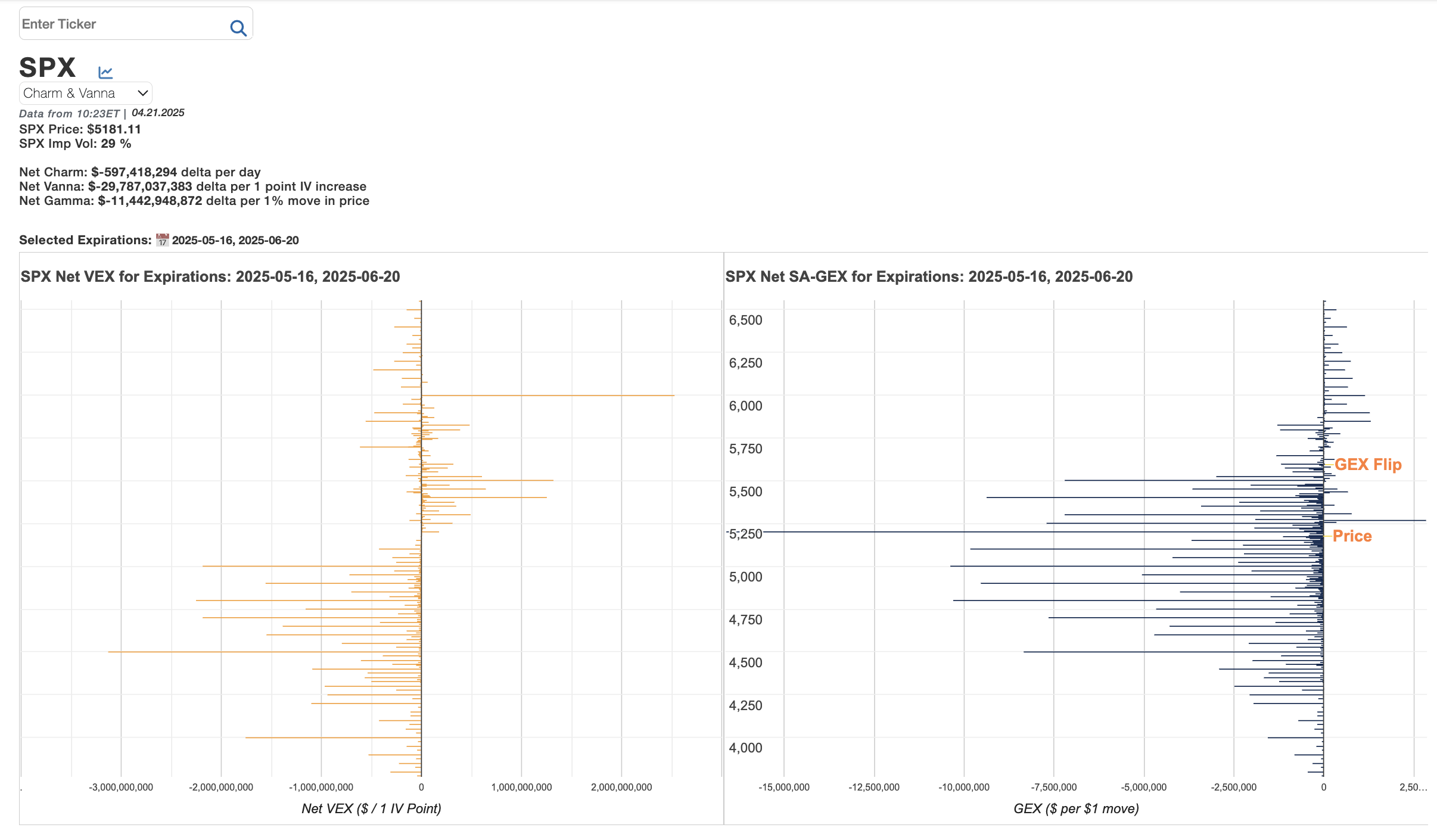

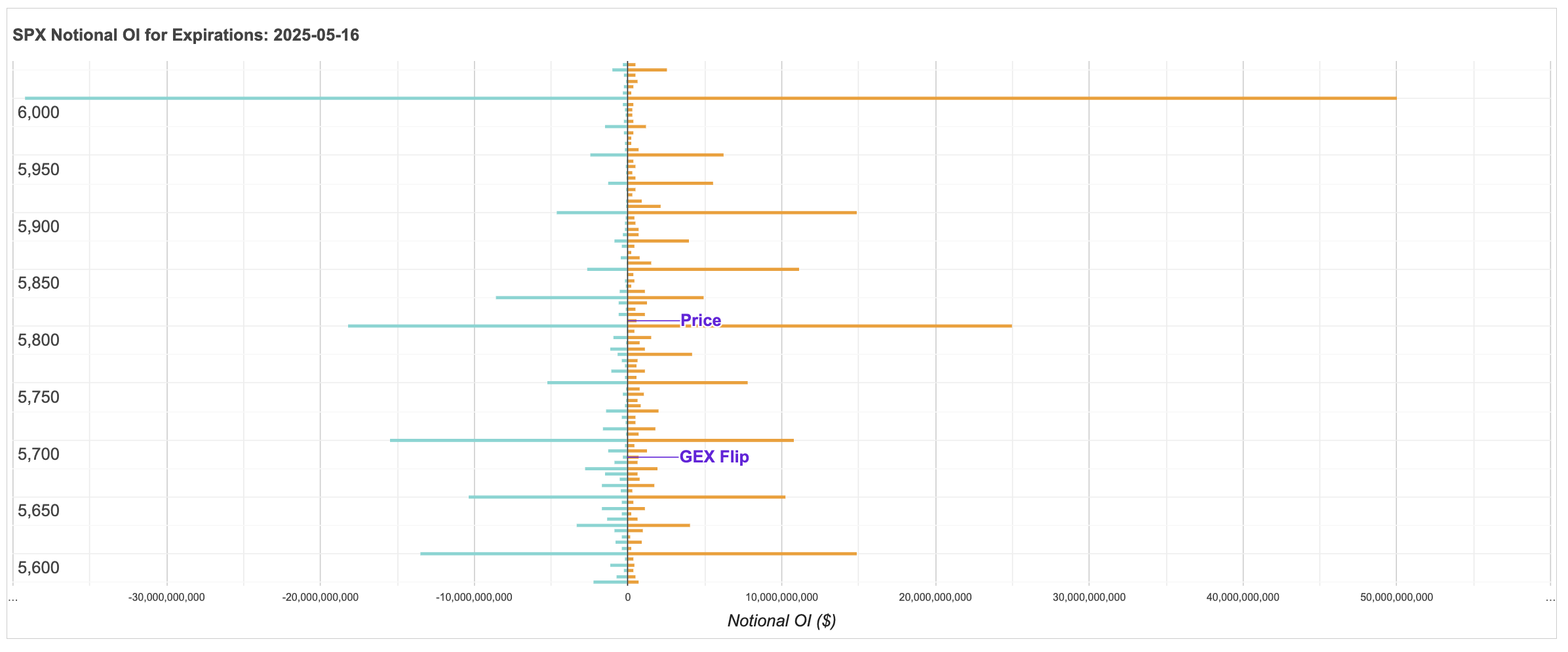

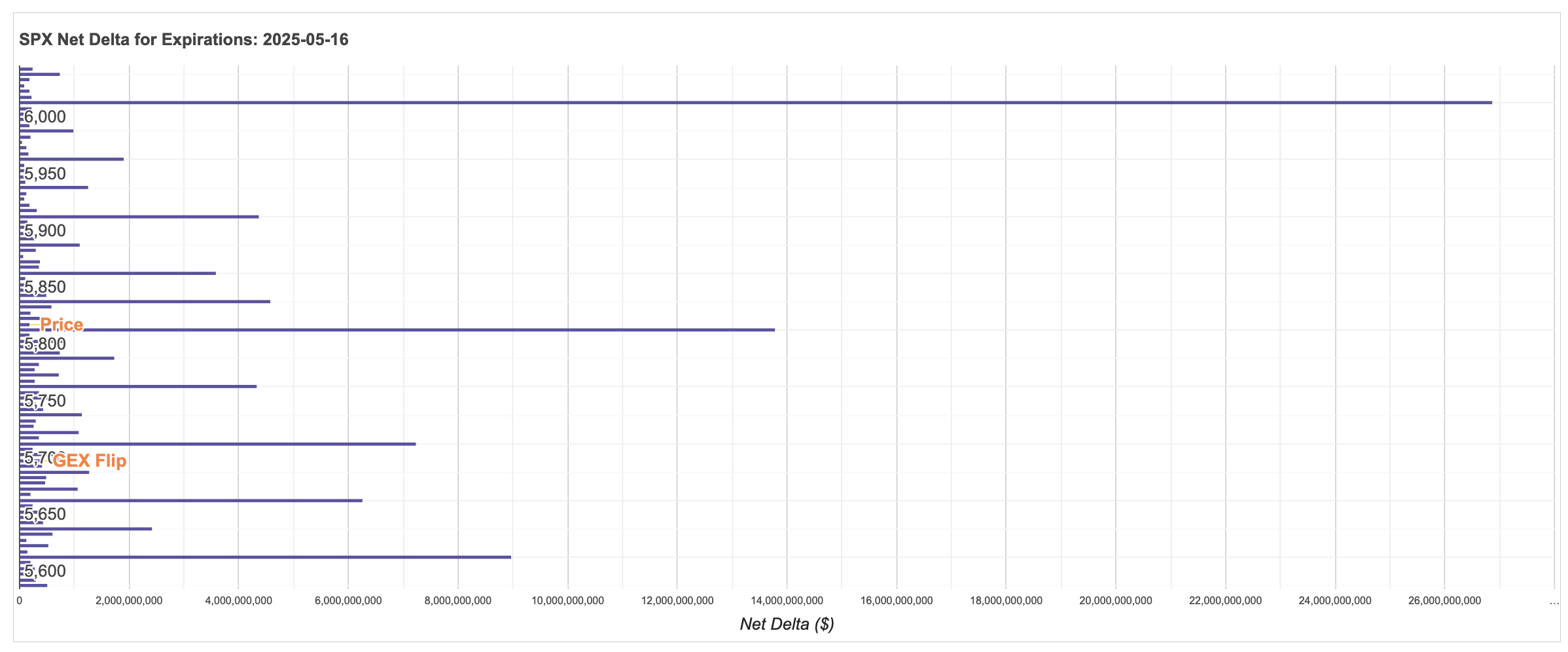

Below is a sample of our Charm and Vanna Exposure charts.

What is Vanna?

Definition: Vanna measures how much an option’s delta changes as implied volatility (IV) changes. It’s crucial because market makers hedge not just against price movement, but also against shifts in volatility.

Why It Matters:

- Vanna becomes especially important during earnings, macro events, or any environment where volatility is expected to shift quickly. As implied volatility rises or falls, market makers adjust their hedges, which can create directional flows in the underlying asset—even when the price hasn’t moved yet.

- Vanna flows can front-run or amplify price moves purely from volatility shifts, creating a feedback loop between IV and price.

Trader Takeaway: During volatility crushes (post-earnings, FOMC), vanna unwinds can push price in unexpected directions. You can anticipate these flows by watching for changes in implied volatility near key strikes or using vanna exposure charts.

How Market Makers Hedge (And Why It Moves Prices)

Market makers aim to stay delta-neutral. Vanna positioning determines what action market makers take as implied volatility changes. Their reactions depend on the vanna regime:

- Positive Vanna: As IV rises, MM deltas increase, so market makers sell the underlying to stay delta-neutral → can dampen upward moves or exacerbate downward moves

- Negative Vanna: As IV rises, MM deltas decrease, so market makers buy the underlying to re-hedge.

Key Concepts

- Volatility Stabilization: Heavy negative vanna can lead to buying flows during IV spikes, providing support in a declining market.

MM VEX Positioning Summary

For short puts:- MM deltas are positive. Short stock to stay neutral.

- Vanna exposure is negative. An increase in IV moves deltas toward zero, which makes MM deltas less positive. MM buys to re-hedge.

- Vanna exposure is positive. An increase in IV makes put deltas more negative, which makes MM deltas more positive. MM shorts more to re-hedge.

For long calls:

- Deltas are positive. Short stock to stay neutral.

- Vanna exposure is positive. An increase in IV makes call deltas more positive, which makes MM deltas more positive. MM shorts more to re-hedge.

- Vanna exposure is negative. An increase in IV moves deltas toward zero, which makes MM deltas less positive. MM buys to re-hedge.

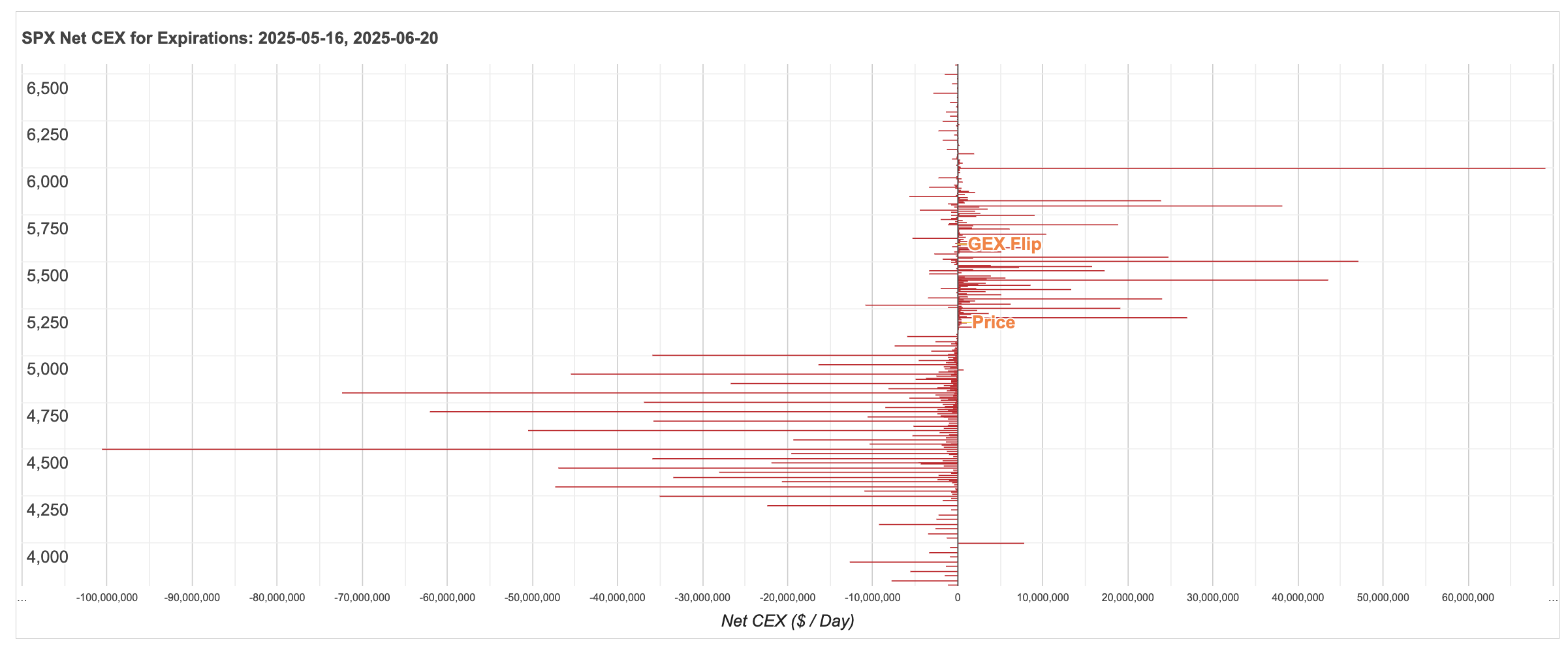

What is Charm?

Charm, also known as delta decay, measures how much an option’s delta changes as time passes. It’s a second-order Greek that becomes critical near expiration, especially for options near the at-the-money (ATM) strike

Why It Matters:

- Charm creates predictable, scheduled flows, especially noticeable into Friday option expirations or during large open interest weeks. It helps explain why markets drift in certain directions without news.

How Market Makers Hedge (And Why It Moves Prices)

Market makers hedge delta exposure, and as delta decays, they must adjust their stock positions daily.

Negative net charm means MM deltas decrease. This means the must re-hedge by buy shares to remain delta-neutral.

Key Concepts

- Charm builds pressure quietly. It's not event-driven — it's clock-driven.

MM CEX Positioning Summary

For short puts:- MM deltas are positive. Short stock to stay neutral.

- Charm exposure is positive. A passing day moves deltas toward -1 so MM deltas move toward 1. MM shorts more to re-hedge.

- Charm exposure is negative. A passing day moves deltas toward zero. MM buys to re-hedge.

For long calls:

- Deltas are positive. Short stock to stay neutral.

- Charm exposure is negative. A passing day moves deltas toward zero. MM buys to re-hedge.

- Charm exposure is positive. A passing day moves deltas toward +1 so MM deltas move toward +1. MM shorts more to re-hedge.

Analyst

Hello! How can I assist you?